Running out of money in retirement is one of the biggest fears that many Americans have. Social Security payments will provide some income, but as traditional pension plans continue to become less common over time, future retirees are increasingly required to take their retirement planning into their own hands. There are popular tax-advantaged options that can help you build up a retirement fund. There are 401(k) plans, 403(b) plans and IRA accounts. These are all great options if you’re looking to save and invest for the future.

IRAs

If you don’t have a work-based retirement plan, you’ll likely have access to an individual retirement account, better known as an IRA. These accounts allow retirement savers to invest $6,000 per year in a tax-advantaged account that allows for tax-free or tax-deferred growth. Those who start an IRA early in life can allow their accounts to grow for decades. There are two main options for investing in an IRA. The first is the traditional IRA, and it provides a tax benefit when you make the contribution. However, withdrawals are taxed at a person’s marginal tax rate.

The other option is the Roth IRA. This type of retirement account does not provide for an up-front tax benefit. However, like the traditional IRA, it allows for tax-free growth over a period of years or decades. Because an investor contributes after-tax money in a Roth IRA, withdrawals are free from any taxation as long as the person who owns the account has reached age 59 1/2.

IRS rules allow people who invest in an IRA to make $1,000 annual catch-up contributions once they reach age 50. This will permit those who had tight budgets when they had children at home to increase their tax-advantaged retirement savings as the kids start to move out of the house. Regardless of whether you choose to use a Roth or a traditional IRA, you’ll want to leave your money alone until you hit at 59 1/2. Otherwise, you’ll have to pay a 10% penalty for the early withdrawal on top of any regular income taxes that are due.

Gold IRAs

According to the experts at Goldco, “Moving your retirement funds into a self-directed IRA gives you the potential for more investment options like real estate, private bonds, private equity, and precious metals like gold and silver.” If you choose to use a self-directed IRA, you can invest in pretty much anything. You don’t have to focus only on stock or bond mutual funds. While you might not want to put all of your investments into this basket, it can make sense to invest a part of your retirement fund in gold or other precious metals.

Moving Your 401(k)To Gold With No Penalties

Many people choose to invest through a 401(k) plan that’s available through their work. Frequently, employers choose to match a certain percentage of their employees’ contributions. A common matching level is 50% or 100% of up to 6% of an employee’s salary. This is hard for many people to pass up. Few people would pass up the opportunity to double their money immediately, and that’s what 401(k) matching funds allow future retirees to do.

You might be wondering how to move 401k to gold without penalty. It’s actually not a terribly difficult process. All you would need to do is find a brokerage that has the ability to allow investments in gold or gold funds. Then, you’d want to initiate a transfer directly from your old 401(k) account into the new brokerage that holds your IRA account. As long as you do not take physical possession of a check, you should not have to worry about triggering any taxes. Once your money is in the IRA, you can invest in pretty much anything you want to. This includes gold.

Why Invest In Gold?

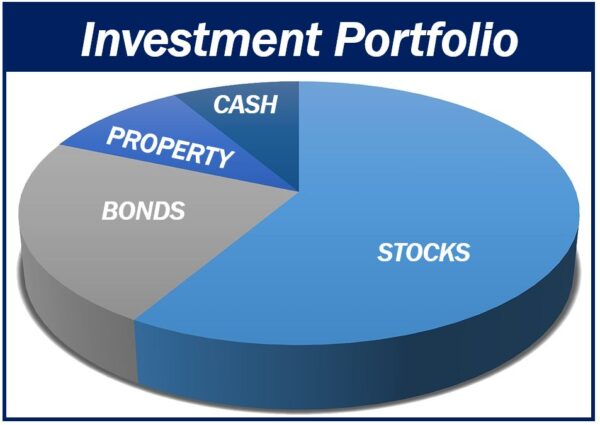

It’s a good idea to invest some money in stocks. They can provide growth, and they can provide income when the underlying companies pay out dividends. However, stocks can be volatile. Their prices go up and down. Gold can provide a hedge against this volatility. It tends to go up in value when stocks are heading down, which can provide an increased level of comfort and stability for those who might be tempted to bail on investing altogether when stocks are in a down market.

Investing in gold through an IRA is a great way to diversify your investments. It can provide for stability when market volatility leads to heartburn for people who throw all of their money into the stock market.