Car insurance is part of an industry that registers an annual average growth rate of about 15%, which makes it a feasible business opportunity to venture into. Most countries make it mandatory for every car owner to have certain basic car insurance cover, and many families own at least one vehicle.

Car insurance business will provide a constant revenue stream for years, since it is renewable for as long as there is a car present. To start your own car insurance company, the following are the major steps you will need to take:

1. Acquire a property and casualty insurance license

Prior to granting your license, a majority of the states will need you to go through a pre-licensing course at an accredited institution, then sit for and pass the state examination. In order to qualify for the pre-licensing course in insurance, you should have a relevant Bachelor’s degree and/or relevant experience. The course is also available online.

2. Outline your business plan

Enlist the guidance of a well-established institution/person to help you with every aspect of the business plan. Outline all your start-up costs and all the business will need until it begins to generate income for itself. This is a crucial step.

Create a detailed business plan for your business, which should outline how you intend to market yourself and bring customers in and the insurance carriers that you will work with. It should also include projected estimates for two years from the starting point.

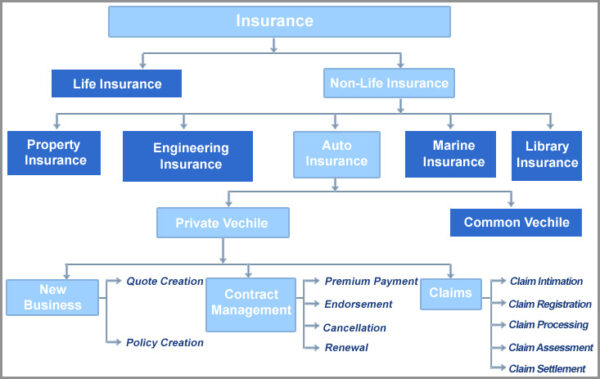

3. Determine what policies you will give

The more policies you offer, the greater the choices that clients will have. There are several policies to select from – liability, comprehensive, multi-car and umbrella policies. This is also the time to determine if you are targeting a specific niche e.g. vintage cars, RV insurance or motorcycle insurance.

You may also elect to joina franchise, which has the benefit of being within a well-established parent organization that can give you access to networks and financing from the parent company. However, you are limited in that you can only offer the products that are on offer within the parent company.

4. Raise capital

Whether through your savings, soft loans from family and friends or a start-up business loan from a lending institution, you should raise the amounts needed to set up office. Ensure that your capital investment is enough to run operations through the startup period until the business begins to realize profits.

5. Get the business insured

You should have your company insured from property losses and lawsuits through a liability and property insurance cover.

6. Choose location

Select a good location based on a thorough research as well as your own personal preferences and experience. It is advisable for you to choose a location in which you have practiced in the insurance industry and therefore have the necessary experience and contacts to begin your own gig. Register your company in that location to acquire a business operating license.

You may not rent out office space on the outset, but you should have a place where you can store your paperwork, make calls and manage your business uninterrupted. You can convert a room in your house initially to save on start-up costs.

However, arrange to let a small space where clients can come to meet you as soon as possible after start-up. It should have a small reception area, and a couple of offices where client consultations can take place uninterrupted. Invest well in your furniture and fittings to make sure the ambience exudes professionalism and stability. You want clients to trust you.

7. Marketing

Market your company through various channels – driving schools, local publications, online and other places in order to grow your client base as fast as possible.