Last updated on November 27, 2016

If you are a retail business owner and happen to be in the process of adopting card payments, you may have heard of EMV. This acronym stands for EuroPay, MasterCard and Visa. It was derived by these three major credit and debit card issuing companies. As a business owner, you should make a point to learn what EMV technology is. Read on to learn why EMV compliant chip and pin readers are a good choice for your business.

What is EMV and how does it Work?

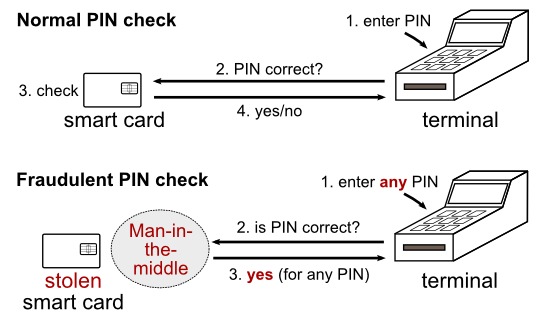

All EMV cards have an embedded microprocessor chip that stores information of the cardholder. A PIN (personal identification number) only known to the cardholder is required to authorize transactions. The following steps describe how a typical EMV transaction would work.

- A contact terminal swallows the card to read the encrypted information on the chip. Alternatively, a cardholder can swipe their credit or debit card at a contactless terminal.

- The EMV reader asks for the cardholder’s PIN after authenticating the chip.

- The cardholder enters their PIN. In order for the transaction to go through, the host processor decodes encryption, verifies the PIN and returns an authorization cryptogram.

Why Invest in EMV Chip Card Technology?

The EMV standard supports secure card transactions. Cards that comply with this standard improve security against fraud compared to those using the old magnetic strip, which can be duplicated easily. Cards with magnetic strips rely on weak verification processes such as the holder’s signature and visual inspection of holograms. EMV transactions on the other hand run complex cryptographic algorithms, which exchange information between the card, terminal and card issuer’s host system to authenticate transactions. Due to this improved verification system, fraud rates have even dropped significantly in some countries that have adopted EMV.

The improved level of security with EMV technology has even encouraged many banks to adopt a liability policy. Some banks now hold merchants responsible for any fraud that results from using credit and/or debit card terminals that are not EMV complaint. In the EU region, the liability shift came in effect on 1 January 2005. Other countries across the world are adopting this standard as well.

Before an EMV solution enters the market, it has to pass many tests. It can be a difficult task to conform with EMV industry standards since they are usually updated. For these reasons, EMV compliant chip and pin machines are trusted.

How to Implement EMV Terminals in Your Business

It is clear by now that EMV terminals are essential for retailers that want to comply with global card payment standards and support secure credit or debit card transactions. However, you may want to know how to implement EMV terminals in your current epos system.

For starters, get to know which brands manufacture EMV capable card readers. You may want to read a few customer reviews to find out what other merchants have to say about the security, reliability and efficiency of various chip and pin manufacturers. Secondly, choose EMV terminals that are compatible with your POS system. You can ask your software vendor which card readers their systems support. Finally, find out what requirements you need to meet to use your chosen EMV terminals. These terminals can run on wireless networks, Ethernet cables or both. With those few tips, you should be able to implement EMV enabled chip and pin readers at checkout terminals in your business.

Be First to Comment